In an era where technology is rapidly evolving, owning the latest gadgets is more accessible than ever, thanks to various financing options. One of the leading names in the tech industry, Samsung, offers flexible financing plans designed to make its innovative products attainable for a wider audience. This blog will delve into the ins and outs of Samsung Financing, helping you understand how it works, its benefits, and what you need to consider before opting for it.

What is Samsung Financing?

Samsung Financing is a program that allows customers to purchase Samsung products through manageable monthly payments rather than a lump sum upfront. This option is particularly appealing for those looking to acquire high-end devices like smartphones, tablets, and smart home appliances without straining their budgets. The financing plans typically come with varying terms, interest rates, and payment durations, depending on the chosen product and the financing partner.

How Does Samsung Financing Work?

Application Process

The application process for Samsung Financing is straightforward. Customers can apply online or in-store. Here’s how it generally works:

- Choose Your Product: Browse Samsung’s extensive product range, from the latest Galaxy phones to cutting-edge smart TVs.

- Select Financing Option: Once you’ve made your selection, you can choose the financing option at checkout. Samsung often partners with financial institutions to offer various plans, including no-interest options for qualifying purchases.

- Submit Your Application: You’ll need to provide some personal information, such as your name, address, income, and Social Security number. This information helps assess your creditworthiness.

- Review and Accept Terms: If approved, you’ll receive the financing terms, including the interest rate, monthly payment amount, and total loan duration. Make sure to read the fine print before accepting.

- Receive Your Product: After completing the financing process, you’ll receive your Samsung product, and your monthly payments will commence.

Financing Terms

Samsung Financing typically offers different terms that can range from 6 to 24 months, depending on the product and the chosen financing plan. It’s important to understand the total cost of financing, including any interest that may be applicable. Some plans might even offer promotional no-interest periods, making them especially attractive.

Benefits of Samsung Financing

Affordability

One of the primary advantages of Samsung Financing is affordability. High-end electronics can be expensive, and financing allows consumers to spread the cost over several months, making it easier to manage within a budget.

Access to the Latest Technology

With Samsung Financing, customers can get access to the latest technology without waiting to save up for it. This is particularly important in the tech industry, where devices can become outdated quickly.

Flexible Payment Options

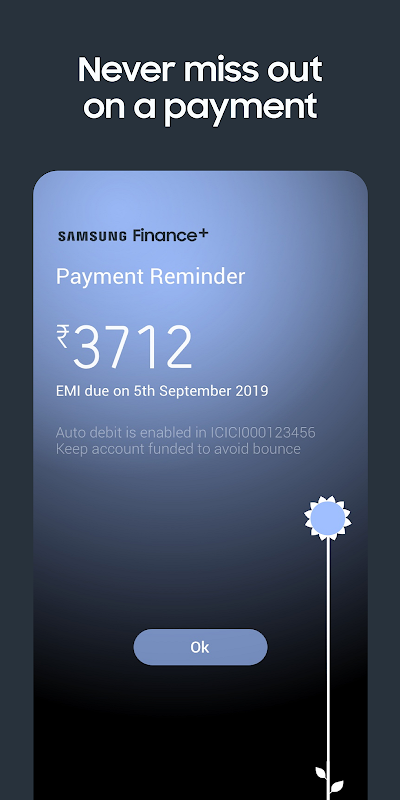

Samsung often provides various payment options, including monthly payments and deferred interest plans. This flexibility enables you to choose a plan that aligns with your financial situation.

Credit Building

Using Samsung Financing responsibly can also help you build your credit. Making timely payments can positively impact your credit score, which can be beneficial for future financing needs.

Considerations Before Choosing Samsung Financing

While Samsung Financing offers numerous benefits, it’s essential to consider a few factors before diving in:

Interest Rates

Always pay attention to the interest rates associated with your financing plan. Some options may offer promotional rates, while others might have higher rates that can significantly increase the total cost of the product over time.

Total Cost of Ownership

Calculate the total cost of ownership, including the principal amount, interest, and any additional fees. This will give you a clearer picture of what you’ll be paying in the long run.

Payment Terms

Review the payment terms carefully. Ensure that the monthly payments fit comfortably within your budget. It’s crucial not to overextend yourself financially.

Impact on Credit Score

While responsible use of financing can boost your credit score, missed payments can negatively impact it. Make sure you have a plan to make timely payments to avoid any adverse effects on your credit profile.

Other Financing Options

Compare Samsung Financing with other financing options available in the market. You may find more favorable terms or lower interest rates elsewhere.

Alternatives to Samsung Financing

If Samsung Financing doesn’t meet your needs or preferences, there are several alternatives to consider:

Credit Cards

Many consumers opt for credit cards with 0% introductory APR offers for purchases. This can be a viable option if you can pay off the balance before the promotional period ends.

Personal Loans

For larger purchases, personal loans from banks or credit unions might offer lower interest rates compared to financing through retailers.

Layaway Programs

Some retailers offer layaway plans that allow customers to pay in installments before taking the product home. This is a good option for those who want to avoid interest altogether.

Buy Now, Pay Later Services

Services like Afterpay or Klarna allow consumers to split their purchase into smaller installments, often with no interest. However, terms can vary, so be sure to read the details carefully.

Conclusion

Samsung Financing can be an excellent option for consumers looking to stay updated with the latest technology without breaking the bank. By understanding how the financing process works, the benefits it offers, and the considerations to keep in mind, you can make informed decisions about your tech purchases. Always evaluate your financial situation and explore all available options to ensure you choose the best financing plan that aligns with your budget and needs.

Whether you’re eyeing a new smartphone, a state-of-the-art television, or any other Samsung product, financing can help bridge the gap between desire and affordability. With the right approach, you can enjoy the latest tech while managing your finances effectively.