The student debt crisis in America has been growing for decades. Total Biden Student Loan Forgiveness debt has now surpassed $1.7 trillion, spread among about 45 million borrowers. The average student debt upon graduation is around $30,000.

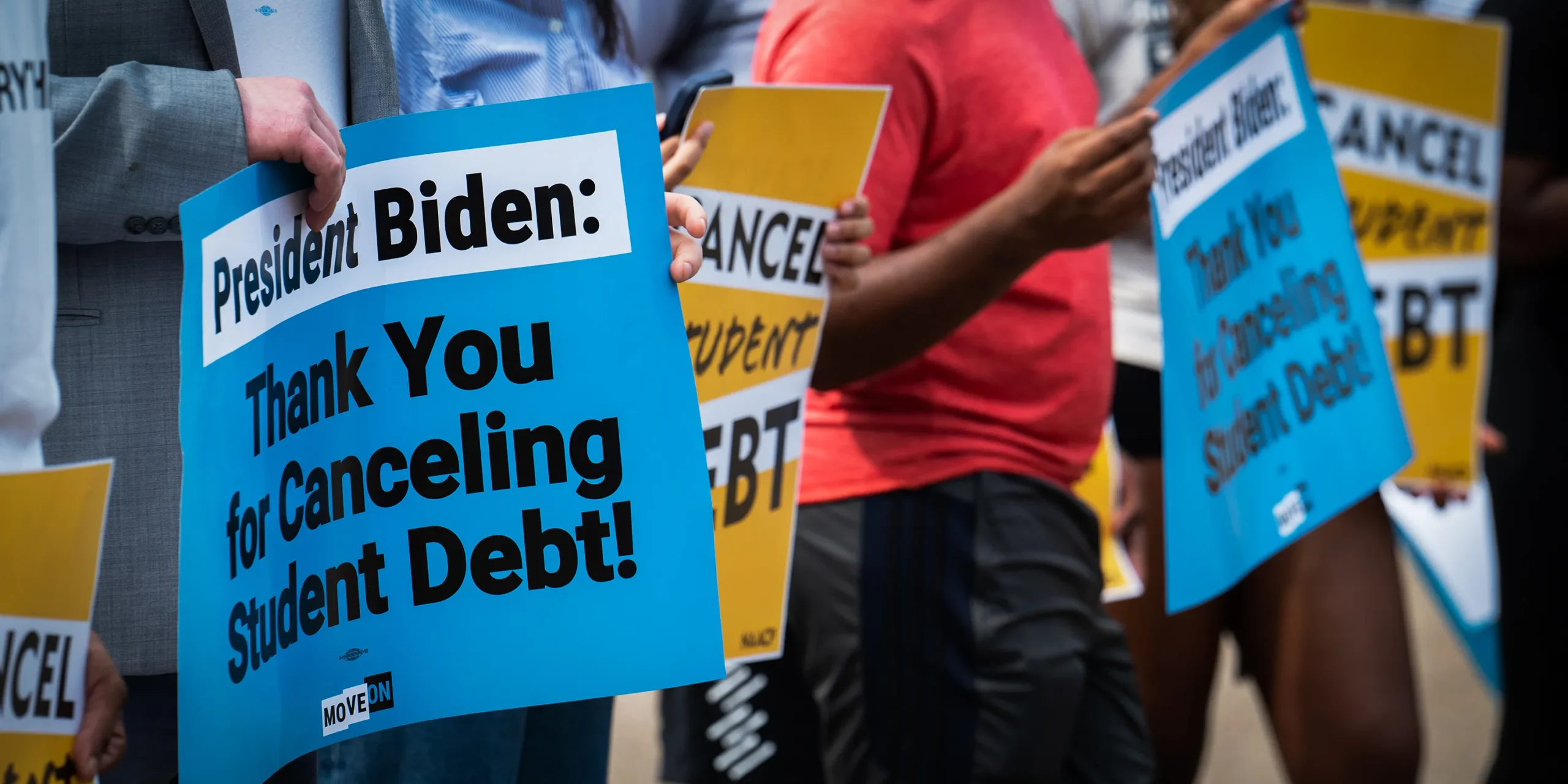

This crisis was a major topic during the 2020 presidential election. Joe Biden campaigned heavily on student debt forgiveness, promising to cancel a minimum of $10,000 per borrower. This promise likely helped secure support among younger voters.

Since taking office, Biden has taken some steps on student debt but has not yet provided broad forgiveness. In August 2022, he announced his administration would cancel up to $10,000 in federal student loans for borrowers making under $125,000 per year. He also extended the pandemic-related student loan moratorium through December 2022.

However, Biden has faced criticism from some Democrats for not fully delivering on his campaign pledge. His actions so far have been seen by many as inadequate given the large student debt burdens faced by millions of Americans.

Biden’s Campaign Promises

During his 2020 presidential campaign, Joe Biden made several prominent promises regarding student loan forgiveness. His plans focused on providing relief for federal student loan borrowers through executive action.

Biden pledged to forgive $10,000 in student loans for all federal borrowers as part of his COVID-19 response plans. This universal forgiveness was presented as a means to stimulate the economy and provide financial relief for millions carrying student debt.

He also promised to forgive an additional $10,000 in federal student loans for borrowers who attended public colleges and universities, as well as Historically Black Colleges and Universities (HBCUs). This provision was designed to provide extra assistance for those who attended school in the public system.

For borrowers who attended private institutions, Biden’s plan still offered some relief. His campaign pledge included forgiving federal student loans for individuals earning under $125,000 per year. This income cap allowed forgiveness to be targeted to middle and low-income borrowers.

During his campaign events, Biden repeatedly stressed the importance of following through on these precise student debt cancellation commitments. He assured borrowers he would take executive action to deliver on these promises shortly after taking office.

Executive Action on Existing Loans

One of the biggest actions Biden took was to extend the pause on federal student loan payments and interest accrual through August 31, 2022. This pause began under the Trump administration at the start of the COVID-19 pandemic in March 2020 and was originally supposed to end on May 1, 2022. Biden’s extension of the pause provides continued temporary relief for millions of borrowers.

In addition to the loan payment pause, Biden extended the pause on interest accrual through August 31, 2022. This means interest will not accrue on federal student loans during this time period. Without the interest waiver, borrowers would have to pay more over the life of their loan when payments resumed.

Biden also approved targeted loan forgiveness of around $6 billion for borrowers in certain situations. This includes loan discharge for borrowers with total and permanent disability, borrowers whose schools closed before they could complete their degree, and borrowers who are eligible for Public Service Loan Forgiveness. While not broad-based forgiveness, this provided relief for specific borrowers faced with hardship.

Overall, these executive actions provided immediate help for federal student loan borrowers as broader reform continues being debated. The payment pause and interest waiver granted temporary financial relief during a time of economic uncertainty. The targeted forgiveness also assisted borrowers in the most challenging situations. While not achieving the large-scale forgiveness he campaigned on, Biden’s executive actions provided some progess.

Income Driven Repayment Changes

One of the changes President Biden made to federal student loans was introducing a new income-driven repayment plan that reduces monthly payments. This new IDR plan caps payments at 5% of discretionary income instead of 10% under previous plans. It also raises the income level where payments are capped and forgives loan balances after 10 years of payments instead of 20 years. This will provide substantial savings for many borrowers struggling with student debt.

In addition to the new IDR plan, the Biden administration has enacted fixes to the troubled Public Service Loan Forgiveness program. These changes will allow over 550,000 public service workers to receive student debt cancellation through an extended waiver period. Biden also improved the PSFL program’s complex requirements to enable more borrowers to qualify and receive forgiveness in the future.

The administration also added a cap on undergraduate loans to reduce overborrowing. This measure prevents undergraduate students from taking out more than $12,500 annually and $57,500 total in federal loans. While these IDR changes don’t include mass debt cancellation, they provide targeted relief and reforms that could significantly ease burdens for millions of borrowers.

Borrower Defense to Repayment

President Biden’s administration has taken significant steps to expand and streamline the borrower defense to repayment process, which allows federal student loan borrowers to have their loans forgiven if their school misled them or engaged in other misconduct.

The Department of Education has announced over $6.2 billion in discharges for thousands of students who were defrauded by for-profit colleges like ITT Tech and Corinthian Colleges. This is the largest amount of loan relief provided through borrower defense claims.

The Biden administration has also expanded eligibility and simplified the application process. Previous borrower defense rules under the Trump administration made it much harder for defrauded students to get relief. The Biden administration has reversed many of these restrictions.

Some of the key changes include:

- Expanding the types of claims eligible for relief beyond just false job placement rates. This includes claims related to illegal or deceptive actions from schools.

- Allowing borrowers to have their federal student loans completely forgiven (previously it was only partial relief).

- Creating a more simplified online application form for submitting claims.

- Reviewing previously denied claims for possible approval.

- Eliminating burdensome paperwork requirements.

Consumer advocates have welcomed these reforms as an important step in providing relief to borrowers who have unmanageable debt from predatory for-profit colleges. However, some policy groups think more could still be done to strengthen borrower protections. Overall, the efforts demonstrate President Biden’s focus on addressing student debt burdens, especially for those impacted by school misconduct.

Forgiveness Limits

President Biden Student Loan Forgiveness plan is limited in scope due to questions about the administration’s legal authority for broad student debt cancellation. While the President campaigned on canceling $10,000 per borrower, the recent executive action is much narrower. The Biden administration concluded it does not have the executive power to enact widespread forgiveness for all student loan borrowers.

Instead, the forgiveness is restricted only to existing types of loans that the Department of Education has clear authority over. Borrowers who took out FFEL loans held by commercial lenders will not receive relief automatically. Only federal Direct Loans owned by the government are eligible. The Department of Education says FFEL borrowers can consolidate into Direct Loans to qualify, but must do so before the end of 2022.

The forgiveness amount is also capped at $10,000 for non-Pell grant recipients and $20,000 for Pell grant recipients. Even this limited means-tested relief required a legal review concluding it aligned with the Heroes Act of 2003 and Higher Education Relief Opportunities for Students (HEROES) Act of 2003. Broader cancellation would likely face lawsuits questioning the executive branch’s unilateral authority.

While the Biden administration determined it can legally forgive certain types of existing federal loans under current laws, across-the-board forgiveness would likely require Congressional action. The forgiveness also does not apply to future students taking out new loans. Opponents argue such limited, one-time relief does not address the root causes of rising debt and college affordability. Supporters counter it still helps millions, but acknowledge bolder solutions require legislation unlikely to pass a divided Congress.

Student Loan Moratorium Impact

The national student loan repayment moratorium has provided temporary relief for federal student loan borrowers. The pause on payments and interest accrual was originally implemented in March 2020 under the CARES Act to help borrowers facing financial hardship during the COVID-19 pandemic. The moratorium has since been extended multiple times by both the Trump and Biden administrations.

The loan payment pause has offered significant financial assistance to millions of borrowers. According to federal data, delinquency rates on student loan debt have decreased from 9.4% in Q1 2020 to 1.6% in Q4 2021. Suspending payments has prevented many borrowers from falling behind on their loans during a period of economic uncertainty and high unemployment.

However, the moratorium comes at a cost to taxpayers. The Congressional Budget Office estimates that the student loan payment pause will cost the government around $95 billion in forgone revenue from interest payments. While providing immediate relief, suspending loan payments reduces cash flow to the federal government. There are also concerns that a prolonged pause may negatively impact borrowers in the long run. Some experts argue that suspending payments reduces borrowers’ incentive to pay down principal, which could increase overall interest costs.

The effects of the student loan moratorium will continue to emerge as its end date remains uncertain. While the relief has assisted borrowers so far, questions persist around impacts on the federal budget, borrower behavior, and the best path forward. The moratorium’s benefits and drawbacks are shaping the debate on broader student debt policy.

Criticisms and Alternatives

President Biden student loan forgiveness plan has prompted debate about whether it goes far enough and what the best approach is for addressing the student debt crisis.

Some argue the forgiveness should be more aggressive, such as proposals to cancel all federal student debt or $50,000 per borrower. Supporters of mass forgiveness say it would provide greater financial relief and stimulate the economy by freeing up income for consumer spending. However, opponents counter that large-scale forgiveness is regressive, providing aid to high earners who took out loans for graduate degrees while excluding Americans who did not attend college.

There are also concerns about the inflationary effects of forgiveness. Reducing or eliminating student debt could pump billions of dollars into the economy, potentially further driving up prices at a time of high inflation. The Biden administration has disputed this risk, but critics argue the stimulus effect cannot be ignored.

Additionally, many believe relief should be better targeted based on financial need and other factors. Blanket forgiveness for all borrowers under an income cap, as Biden enacted, helps many who are financially stable. A more selective approach could restrict relief to those truly struggling with their loans. Alternatives include expanding existing income-driven repayment programs or basing forgiveness on an individual’s assets and debts.

Overall, while Biden’s plan delivers meaningful aid to millions, reasonable concerns remain about whether it strikes the right balance on the amount of relief and targeting those most in need. His executive actions are unlikely to end debate over the fairest way to tackle student debt at the federal level.

Future Outlook

While Biden’s student loan forgiveness actions so far have provided relief to millions, the future holds uncertainty and the potential for further reform.

Biden may pursue additional executive action on student debt forgiveness, but his powers are limited without Congress. He could attempt more targeted forgiveness for specific groups, but broad cancellation of debt seems unlikely without legislation.

Biden has expressed support for proposals like the College for All Act, which would eliminate tuition at public colleges and universities. However, major legislation would require approval from both the House and Senate, which will be challenging.

The midterm elections in November 2022 could shift control of Congress and impact the feasibility of passing student loan bills. If Republicans gain ground, Biden would have less support for his legislative agenda. On the other hand, Democrats gaining seats could improve the chances for student debt reform.

In the coming years, the Biden administration will need to balance executive action with working to build congressional support for impactful legislation. While future moves on student loans remain uncertain, the issue will continue to be an important one for progressive voters.

Conclusion

President Biden has taken several executive actions related to federal student loan forgiveness since taking office, working to fulfill his campaign promises to provide relief for student borrowers. Key actions include:

- Extending the pandemic moratorium on federal student loan payments through August 2022, giving borrowers over two years without required payments. This pause on payments alone is providing significant financial relief.

- Approving over $25 billion in student loan forgiveness through improvements to existing programs like Public Service Loan Forgiveness and Borrower Defense to Repayment. Hundreds of thousands have already had balances discharged.

- Proposing a new income-driven repayment plan that would cap payments at 5% of discretionary income and provide forgiveness after 10 years for those with original loan balances under $12,000. This could benefit millions of borrowers.

While these actions provide tangible relief for many borrowers, some argue they fall short of Biden’s campaign proposal for $10,000 in across-the-board federal loan forgiveness. However, Biden has publicly stated he is still considering broader forgiveness and working to assess his legal authority to enact it through executive action.

Potential next steps could include extending the payment pause further, tweaking the proposed income-driven repayment changes, or announcing a broader forgiveness program if legal authority can be established. Regardless, Biden has taken clear action to improve federal student loan programs and deliver on his promises to student borrowers. While the job is not done, meaningful progress has been made.