Introduction to Quicken Software

Quicken is a powerful personal finance software developed by Intuit Inc. It is designed to help individuals and families manage their finances, track expenses, create budgets, and plan for their financial goals. At its core, Quicken aims to provide users with a comprehensive overview of their financial situation, enabling them to make informed decisions and achieve better financial control.

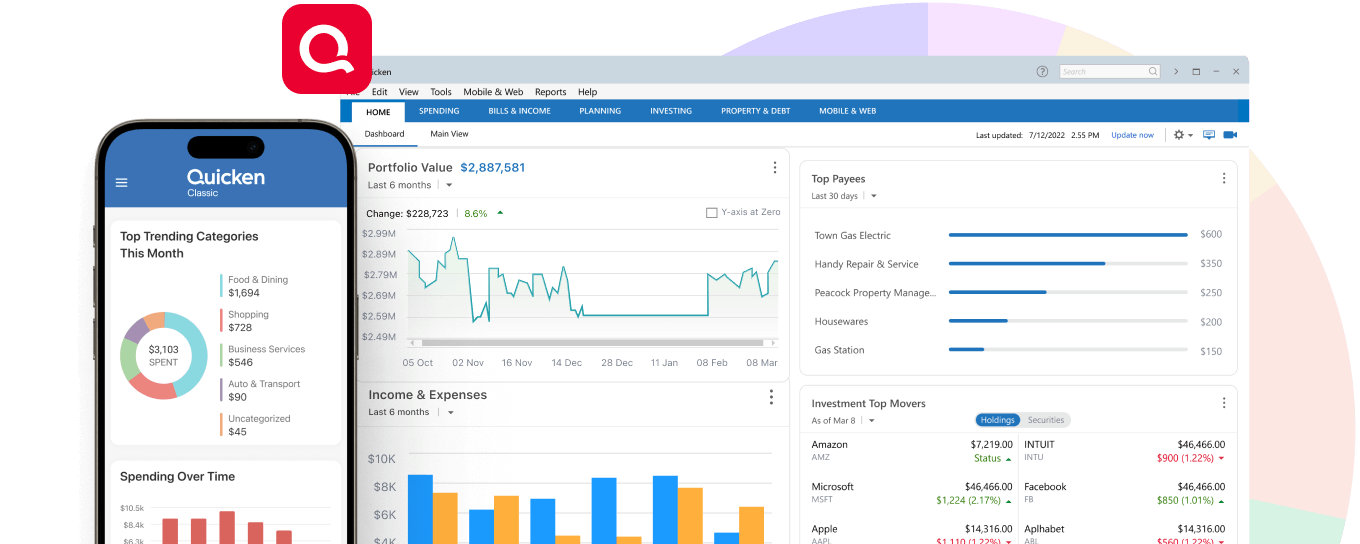

The software offers a wide range of features that cater to various financial needs. Users can easily connect their bank accounts, credit cards, and investment portfolios, allowing Quicken to automatically import and categorize transactions. This streamlines the process of tracking income and expenses, eliminating the need for manual data entry.

One of Quicken’s standout features is its budgeting capabilities. Users can create detailed budgets based on their income and expenses, set spending limits for different categories, and monitor their progress towards their financial goals. Quicken’s intuitive interface and visual representations make it easy to identify areas where adjustments may be needed, empowering users to make informed decisions about their spending habits.

History of Quicken

The first version of Quicken, released in 1984, was designed for the Apple II computer and quickly gained popularity among consumers who were seeking an easy way to manage their finances.

Over the years, Quicken underwent numerous updates and enhancements, with new versions released regularly to keep pace with changing technology and user demands. Major milestones in Quicken’s history include the release of Quicken for Windows in 1992, which opened the software to a wider audience, and the introduction of online banking and investment tracking features in the late 1990s.

In the early 2000s, Intuit faced competition from other personal finance management software and online services, but Quicken remained a dominant player in the market. The company continued to innovate, introducing features like mobile access, cloud synchronization, and integration with popular financial institutions and services.

Today, Quicken remains a trusted name in personal finance software, with millions of users worldwide relying on its comprehensive suite of tools to manage their money, track investments, and plan for the future. Despite the rise of free online budgeting tools and mobile apps, Quicken’s longevity and commitment to continuous improvement have solidified its position as a leader in the personal finance software industry.

Key Features of Quicken

Quicken is a comprehensive personal finance management software that offers a wide range of features to help users manage their finances effectively. Here are some of the key features that make Quicken a powerful tool:

Budgeting and Expense Tracking: Quicken’s budgeting tools allow users to create detailed budgets, track their income and expenses, and monitor their spending patterns. Users can categorize their transactions, set up recurring payments, and receive alerts when they exceed their budget limits.

Banking and Bill Pay: Quicken seamlessly integrates with online banking and bill payment services, enabling users to securely download transactions from their bank accounts and pay bills directly within the software. This feature streamlines the process of reconciling accounts and ensuring timely bill payments.

Investment Tracking: Quicken provides robust investment tracking capabilities, allowing users to monitor their portfolios, track gains and losses, and analyze their investment performance. Users can import data from various brokerage accounts and view consolidated reports for their investments.

Tax Planning and Reporting: Quicken simplifies tax preparation by automatically categorizing tax-related transactions and generating reports that can be easily exported to popular tax software. Users can also estimate their tax liabilities and plan for tax-deductible expenses.

Debt Management: Quicken offers tools to help users manage their debts, including loans, credit cards, and mortgages. Users can create debt reduction plans, track their progress, and receive reminders for upcoming payments.

Goal Setting and Savings Tracking: Users can set financial goals, such as saving for a down payment on a house or building an emergency fund, and track their progress within Quicken. The software provides visual representations and projections to help users stay motivated and on track.

Mobile Access: Quicken offers mobile apps for iOS and Android devices, allowing users to access their financial data and manage their finances on the go. The mobile apps sync seamlessly with the desktop version, ensuring that users have access to up-to-date information.

Customization and Reporting: Quicken provides extensive customization options, allowing users to tailor the software to their specific needs. Users can create custom reports, customize categories, and even import data from spreadsheets or other financial software.

With its comprehensive set of features, Quicken empowers users to take control of their finances, streamline their financial management processes, and make informed decisions about their money.

Quicken is a powerful personal finance management tool that helps individuals take control of their financial lives. With its comprehensive set of features, Quicken simplifies the process of tracking income, expenses, and budgets, providing a clear picture of your financial situation.

One of the key strengths of Quicken is its ability to automatically download and categorize transactions from your bank accounts, credit cards, and other financial institutions. This eliminates the need for manual data entry, saving you time and ensuring accuracy. Quicken’s intelligent categorization system learns from your spending habits and makes it easy to organize your expenses into customizable categories, such as groceries, utilities, and entertainment.

Creating and managing budgets is a breeze with Quicken. The software allows you to set up customized budgets based on your income and expenses, and it provides visual representations of your spending patterns through charts and graphs. This helps you identify areas where you may be overspending and make informed decisions about where to cut back or reallocate funds.

Quicken also offers robust bill management capabilities, allowing you to schedule and track upcoming payments for mortgages, loans, utilities, and other recurring expenses. You can set up reminders and even automate payments, ensuring that you never miss a due date and avoiding late fees or penalties.

For those with investments, Quicken provides a comprehensive portfolio tracking tool that allows you to monitor the performance of your stocks, bonds, mutual funds, and other investment accounts. You can easily view your asset allocation, track gains and losses, and analyze your investment performance over time.

Quicken for Small Business Accounting

Quicken offers a range of features tailored for small business owners and self-employed professionals to manage their finances efficiently.

One of Quicken’s strengths lies in its invoicing capabilities. Users can create customizable invoices with their company branding, track outstanding payments, and set reminders for follow-ups. This streamlined invoicing process helps ensure timely payments and improves cash flow management.

For businesses with employees, Quicken offers payroll management features. Users can calculate and file payroll taxes, print paychecks, and maintain comprehensive records for compliance purposes. This functionality can save small business owners time and reduce the risk of errors associated with manual payroll processing.

Small business owners can gain insights into their financial performance, identify areas for cost optimization, and make data-driven decisions to drive growth.

Transactions can be automatically downloaded and categorized, reducing manual data entry and ensuring accurate record-keeping.

Investment and Retirement Planning with Quicken

Quicken offers robust investment tracking and retirement planning tools to help users manage their portfolios and plan for their financial future. With Quicken, you can easily track your investments across various accounts, including brokerage accounts, 401(k) plans, IRAs, and more.

The software allows you to import data from your financial institutions, ensuring that your investment information is always up-to-date. Quicken automatically categorizes your investments, making it easy to see your asset allocation and diversification at a glance.

One of the standout features of Quicken is its portfolio analysis tools. The software provides detailed reports and charts that allow you to analyze your investment performance, track your gains and losses, and monitor your asset allocation over time. You can also set up customized alerts to stay informed about significant changes in your portfolio.

For retirement planning, Quicken offers a comprehensive suite of tools to help you plan for your golden years. You can create retirement scenarios based on your current savings, projected income, and desired lifestyle. You can easily adjust your assumptions and see how different scenarios would impact your retirement readiness.

With its intuitive interface and comprehensive analysis tools, Quicken empowers users to make informed decisions about their investments and retirement planning.

Integration and Connectivity

Quicken’s integration and connectivity features are one of its key strengths, allowing users to seamlessly link their financial accounts and automatically sync transactions. This eliminates the need for manual data entry, saving time and reducing the risk of errors.

Quicken supports direct connections with thousands of financial institutions, including banks, credit card companies, brokerages, and loan providers. Users can securely link their accounts by providing their online banking credentials within the Quicken software

For financial institutions that don’t offer direct connectivity, Quicken provides web-based connectivity options. Users can download transaction data from their bank’s website and import it into Quicken, ensuring their financial data remains up-to-date.

This feature integrates with the user’s linked bank accounts, providing a centralized platform for managing bill payments and tracking due dates.

. It includes features like income and expense tracking, budgeting tools, and bill payment reminders. The Starter Edition is available for a one-time purchase of $34.99.

The Deluxe edition is available for a one-time purchase of $54.99 or an annual subscription of $49.99.

It also offers premium support and access to Quicken’s online backup service. The Premier edition is available for a one-time purchase of $77.99 or an annual subscription of $74.99.

It includes features like invoicing, expense tracking, and tax preparation tools. The Home & Business edition is available for a one-time purchase of $107.99 or an annual subscription of $99.99.

In addition to these desktop versions, Quicken also offers an online subscription service called Quicken Cloud. This cloud-based solution provides access to Quicken’s financial management tools from any device with an internet connection. Quicken Cloud is available for an annual subscription of $47.88.

First, install the software and create your Quicken account.

Simply link your accounts, and Quicken will securely download your transaction data, saving you the hassle of manual entry. Here are some common use cases:

Budgeting: Create a budget and track your income and expenses to see where your money is going. Quicken’s budgeting tools help you stay on top of your spending and achieve your financial goals.

Bill Paying: Streamline your bill payment process by setting up reminders and scheduling payments directly from Quicken. You can even pay bills electronically from within the software.

Investment Tracking: Monitor your investment portfolio, including stocks, bonds, and mutual funds. Quicken provides detailed reports and analysis to help you make informed investment decisions.

Tax Preparation: As you track your finances throughout the year, Quicken automatically organizes your data for tax time, making it easier to prepare your tax returns.

Debt Management: Keep track of your loans, mortgages, and credit card balances, and develop a plan to pay off your debt more efficiently.

Reporting and Analysis: Gain valuable insights into your financial situation with Quicken’s comprehensive reporting tools. Generate reports on your net worth, cash flow, and more.

Quicken is not the only personal finance software available in the market. There are several alternatives that offer similar features and functionalities. Some of the popular competitors include Mint, You Need a Budget (YNAB), Personal Capital, and GnuCash.

You Need a Budget (YNAB) is a budgeting software that follows the zero-based budgeting approach. It emphasizes giving every dollar a job and prioritizing expenses. YNAB is known for its robust budgeting tools and active community support.

Personal Capital is a comprehensive financial management platform that caters to individuals with significant investments and assets. It provides robust features for tracking investments, generating reports, and managing multiple accounts.

Quicken offers a range of customer support and resources to assist users in getting the most out of their software.

Available Support Channels:

- Phone Support: Quicken provides toll-free phone support, where you can speak directly with a customer service representative for personalized assistance.

- me.

Documentation and Tutorials:

Quicken’s website houses an extensive knowledge base and a collection of user guides, tutorials, and FAQs. These resources cover a wide range of topics, from basic setup and navigation to advanced features and troubleshooting. The documentation is designed to be user-friendly and easy to understand, catering to users of all skill levels.

Community Forum:

The forum is moderated by Quicken experts and experienced users, ensuring that accurate and helpful information is provided.

Video Tutorials and Webinars:

These visual resources provide step-by-step guidance on various aspects of the software, making it easier to understand and follow along.

Quicken Security and Privacy

Quicken takes the security and privacy of your financial data very seriously.

The company does not sell or rent user data to advertisers or other entities.

The Future of Quicken

. This could include features like real-time expense tracking, mobile account synchronization, and push notifications for important financial events or alerts.

Pros and Cons of Using Quicken

Pros:

-

This all-in-one solution can simplify financial organization and provide a holistic view of your financial situation.

-

The software provides clear visualizations and reports, making it easier to understand and analyze financial data.

-

Customization and Flexibility: Quicken allows users to customize categories, reports, and budgets according to their specific needs. This flexibility enables users to tailor the software to their unique financial situations and preferences.

-

This feature helps ensure that financial records are up-to-date and accurate.

Cons:

-

Limited Mobile Access: This can be inconvenient for users who prefer to manage their finances on-the-go.

-

Users must be diligent in maintaining strong passwords and keeping their software up-to-date to mitigate these risks.